Source/Paytm

What is UPI?

UPI is a payment system by NPCI (The National Payments Corporation that regulates payments in India). It is an initiative of the Reserve Bank of India and Indian Banks.

Let me take you on a journey down memory lane, to a time when we would make payment using debit or credit cards.

Picture this, you are in 2015. We would use debit or credit card for online payment. So the process was…you would reach into your wallet, pull out your debit or credit card, to initiate the transaction. You would squint at the tiny print on the card and start entering the 16-digit number, expiry date and the three-digit CVV code on the back of the card. and then OTP…. Phew, finally, the payment goes through!

Before UPI came into the picture, the task was quite simple and easy for us. But now, we can’t repeat the same task again as we have blazing fast payment system – UPI. Which is safe, secure and fast.

In 2016, UPI payment system was introduced and it revolutionized the way we make payments in India. With the convenience of scanning a QR code, we can now easily pay small vendors on the streets without having to carry cash.

With the introduction of UPI Lite, paying has become even more convenient. You no longer need to enter a PIN to complete your transaction. Simply scan the QR code and pay within seconds.

The payment process has become incredibly fast and convenient with the introduction of UPI. By simply scanning and entering a pin, payments can now be completed in a matter of seconds, which is truly remarkable.

Requirements to Create an UPI ID?

To create a UPI ID you must have:

- A smartphone

- A bank registered phone number

- Debit card details (which is a one-time process)

UPI cannot be created or used without a bank-registered SIM card inserted in your phone.

Make sure that your smartphone has a bank-registered SIM card inserted before proceeding with UPI. Assuming that your phone already has a SIM card, you’re good to go!

Step 1: Choose an App

There are several UPI-supported apps available, which means you can create UPI ID using these apps. Paytm, Freecharge, Mobikwik, Gpay, Phonepe, Cred, and the Indian government’s BHIM app are popular apps that allow you to create UPI.

Step 2: Download the App

Step 2: If you don’t have the app already, download it, or open it if you already have it. In this example, we will use Paytm since it is a widely-used app.

Start Registration

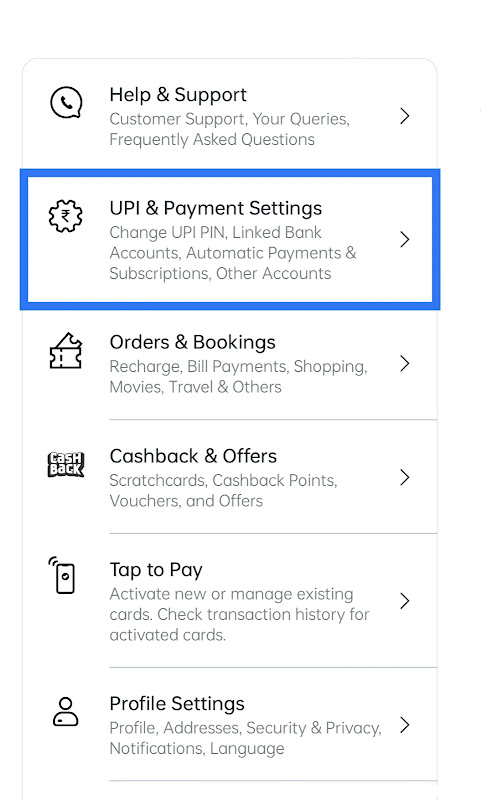

- Click on Profile (top-left corner):

- Now click on the UPI option:

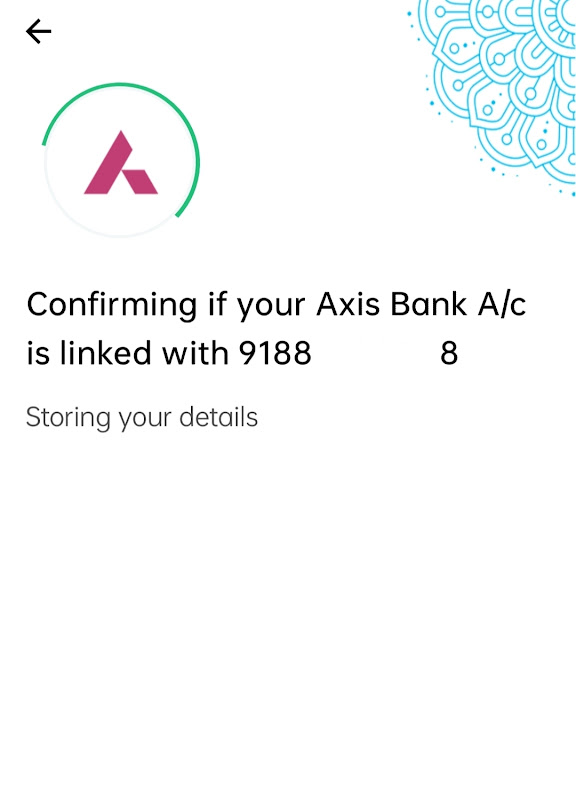

- It will send an SMS to verify your phone number.

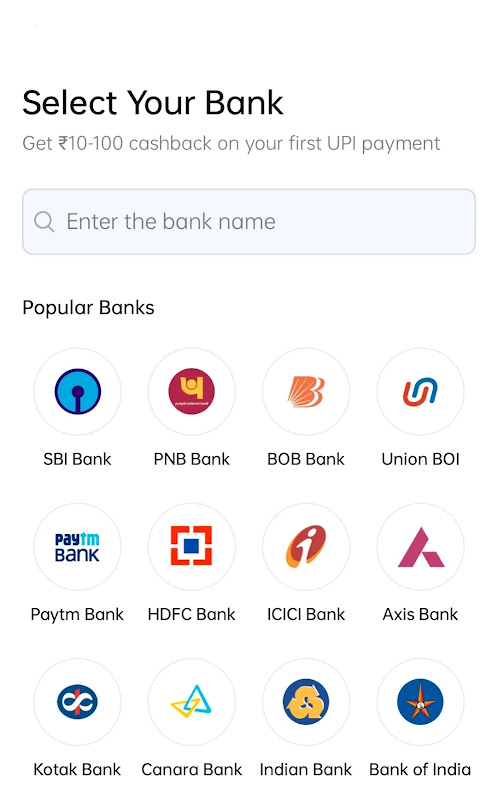

- Once SMS is sent, you can select the registered bank.

- Select bank account

Create UPI Pin

To generate a UPI PIN, you’ll need to provide the last six digits and expiry date of your debit card. After verifying the information, you’ll be prompted to create a UPI PIN which will be necessary for making payments each time. Once you’ve set up your PIN and UPI ID, you can start using UPI.

It is possible to create a UPI ID of your choosing, including one based on your phone number.

This process is same on every app, in case of Google Pay, Phonepe, BHIM, etc.