PhonePe HDFC Bank Credit Card: Features & Offers

Co-branded credit cards are on the rise, now making up 12-15% of India’s credit card market, up from just 3-5% in 2020. There are so many reasons behind their rising popularity, one of which is that they offer higher cashback and discounts on partner platforms.

Now, PhonePe, in collaboration with HDFC, is set to launch an exclusive card — PhonePe HDFC Bank Cards — Uno and Ultimo. Both cards will be available in the RuPay variant, providing UPI payment facility and exciting cashback offers.

Both cards have different features, so you can choose the one that suits your spending. You just need the PhonePe app to apply; the whole process is online. Once you get the card, you can add it on PhonePe and use it for recharges, bill payments, shopping, travel, etc.

If you’re someone who uses UPI regularly for recharges, bill payments, travel bookings, or grocery shopping, then this new PhonePe HDFC Bank Credit Card might catch your attention.

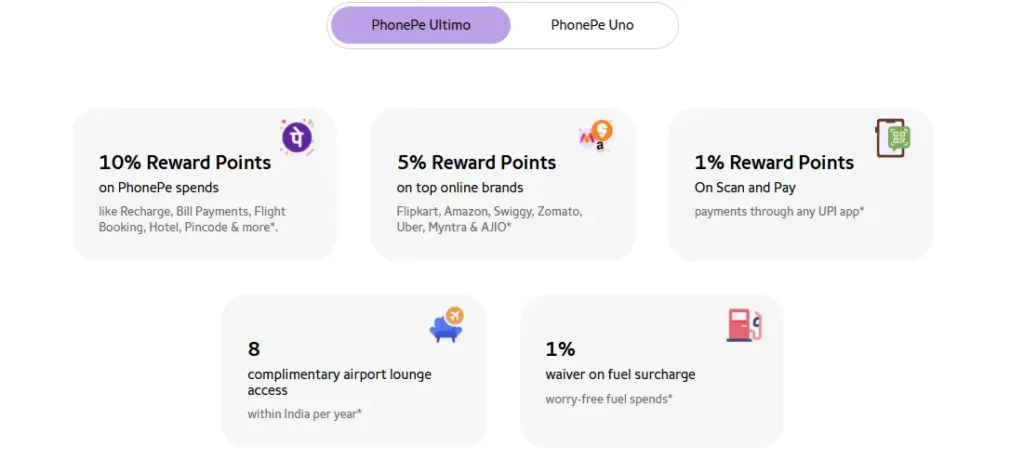

Now, let’s go through the features and rewards of both card variants.

PhonePe Ultimo [Premium Variant]

- Joining fee: INR 999/Year + GST

- Best for regular spenders via PhonePe

- Offers:

- ₹499 cashback on first UPI payment

- ₹50 cashback on the next 10 UPI transactions

- 10% cashback on payment via Phonepe (recharge, bill payments, travel)

- 5% cashback on Amazon, Flipkart, Swiggy

- 1% cashback on other UPI spends

- 8 complementary domestic longue access/year

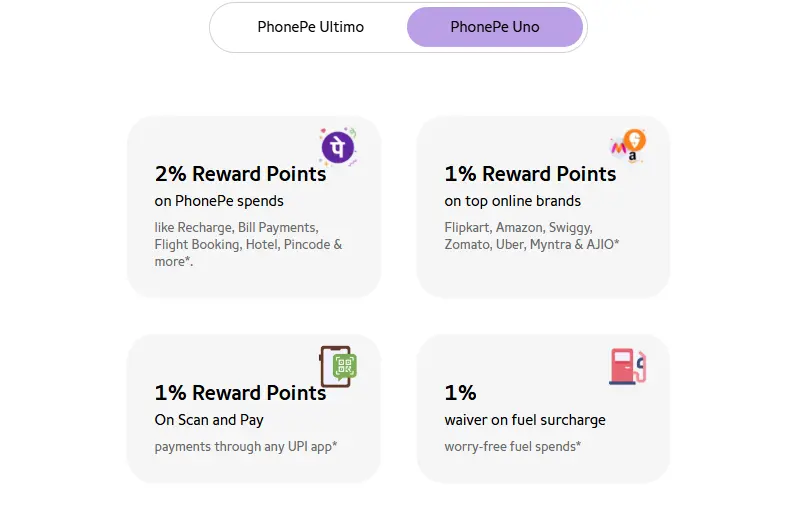

PhonePe Uno [Basic Variant]

- Joining fee: INR 499/year + GST

- Offers

- ₹249 cashback on 1st UPI txn

- ₹25 cashback × 10 UPI txns = ₹250

- 2% rewards on PhonePe spends

- 1% on Amazon, Flipkart, Swiggy, etc.

- 1% on UPI spends

- No lounge access

- 1% fuel surcharge waiver

Comparison of UNO & Ultimo Card Features

Benefits of PhonePe HDFC credit card

1. 10% rewards category

If your regular spends are on things like recharges, utility bills, travel, or shopping within the PhonePe app, then the 10% reward on those categories is what makes the Ultimo card better than others.

2. Rewards Points

Users will receive cashback in the form of reward points that are valid for a year. RPs can be redeemed directly as statement credit.

3. Cashback on E-commerce platforms

Ultimo users will receive 5% cashback on Amazon, Flipkart, Ajio, Myntra, Swiggy, Zomato, and Uber. Just remember, Uno gives 1% and Ultimo gives 5% on these platforms. If you use the PhonePe payment option during checkout (especially UPI intent-based), you could easily get those reward points.

How to Apply For HDFC PhonePe Card?

Right now, it’s invite-only. Only eligible users can see the option inside the PhonePe app. The card will be made available to eligible PhonePe users in phases.

![10 Best Credit Card Payment Apps in India [in 2025] 14 10 Best Credit Card Payment Apps in India [in 2025]](https://tricksszone.com/wp-content/uploads/2024/11/Best-credit-card-bill-payment-app-768x431.webp)

![[Ended] Credit Card Bill Payment Offers 21 credit card bill payment offers banner image](https://tricksszone.com/wp-content/uploads/2025/01/Credit-card-bill-payment-offers-768x431.webp)