Navi App Cashback Offers in 2025 | Navi Refer & Earn

In this article, we will talk about Navi app cashback offers, as it rewards users for making bill payments and UPI transactions. Navi is a fintech app that lets you recharge, pay bills, make credit card payments, and make online and offline transactions via UPI. One of its main features is that you can also apply for loans through the app. But that’s not all.

You can earn cashback on recharges and bill payments too. Navi gives cashback in the form of Navi Coins, which you can convert into real cash and transfer to your bank account. So, let’s explore Navi’s cashback and Navi UPI cashback offers.

Navi App Cashback Offers

The Navi app doesn’t have any special offers for old users, but it gives assured Navi Coins on every payment. However, old users can still get up to ₹100 cashback on their first transaction.

1. Get up to ₹100 Cashback

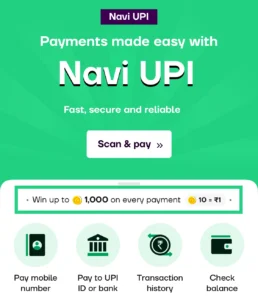

The Navi app gives you up to ₹100 cashback (1000 Navi coins) on your first payment. You can claim this cashback by scanning and paying at a nearby merchant or by sending money to any user. To get started, download the app from Google Play or the App Store.

Steps:

- Download the app and set up your UPI.

- Make any payment (at least ₹1).

- After a successful payment, you’ll get a scratch card.

- Claim your cashback.

Navi gives you Navi Coins when you do recharges, bill payments, or make UPI Scan & Pay transactions.

Value of Navi Coins

If you convert Navi Coins into real cash, 1 Navi Coin is worth ₹0.10. So, if you earn 10 Navi Coins from a transaction, that’s equal to ₹1.

However, Navi’s cashback terms aren’t very clear. Sometimes, it might give you up to 1000 coins for a small transaction, but that’s pretty rare. In the beginning, you might get good cashback on your first few transactions, but if you keep using it regularly, the rewards drop to almost nothing. So, to maximise cashback on UPI payments, you can combine it with other apps like Kiwi or Jupiter.

Simply put, if you’re relying on just one UPI app for payments, chances are you’re earning very little cash back. But if you have multiple apps like Cred, Kiwi, or Jupiter and keep switching between them for payments, you can maximise your UPI cashback.

Now, coming back to the Navi UPI app. When you sign up, you get a ₹100 joining bonus (or 1000 Navi Coins). Apart from that, Navi also runs UPI and bill payment offers from time to time, which you can check directly in the app.

UPI Offers on Navi

If you use Navi once in a while, you might get better cashback. But if you’re using it regularly, its UPI benefits aren’t that great.

If you’re looking for the best UPI apps, we’ve put together a separate article where we’ve compiled some of the top UPI apps, or you could say, my personal favourites. You can check out the best UPI apps 2025.

For me, Navi UPI doesn’t offer any major benefits except for the assured Navi Coins it gives on every transaction. That said, some users have managed to get really good cashback through the Navi app, so you can try your luck too.

Navi Referral Program [Refer & Earn]

Navi has launched a new refer-and-earn offer where both the referrer and the referee get rewarded. When you refer someone using your Navi referral link, and they sign up and make a bill payment of ₹200 or more (credit card or other bill):

- Download Navi app [Navi referral link]

- Register and go to refer and earn section

- Get your referral link

- Invite your friends on Navi

- When they make minimum payment of ₹200

-

You (Referrer) get ₹100 worth of coins

-

Your friend (Referee) gets ₹50 worth of coins

-

Learn about Navi refer and earn program in detail.

Features of Navi App

1. Instant Transfer

Using UPI, you can make instant transactions with ease. Navi rewards you with something on every transaction.

2. UPI Lite

If you like the UPI Lite feature, Navi offers it too. With this, you can make small transactions without needing a PIN.

3. UPI via RuPay Credit Card

You can also make UPI payments using a RuPay credit card through the Navi app.

4. Recharge & Bill Payments

Enjoy recharges and bill payments with no processing fees, along with fast and successful transactions.

5. Navi Trezo – Buy Now, Pay Later

If you don’t have a credit card, Navi Trezo allows you to use the Buy Now, Pay Later (BNPL) option.

6. Investments

You can invest in mutual funds, SIPs, and stocks. Navi lets you invest in both domestic and international company stocks.

7. Health Insurance

Navi also offers health insurance plans for users.

8. Loans – Primary Feature

Since loans are Navi’s main service, you can apply for a loan directly through the app.

Want to earn assured cashback on every UPI payment? Check out Super.money, launched by Flipkart, which offers up to 5% cashback on every UPI transaction. Plus, get a free credit card against FD and much more. Check out Super.money cashback and benefits now.

![11 Best UPI Cashback Apps [Flat 5% Rewards] 6 Best UPI cashback apps in 2025](https://tricksszone.com/wp-content/uploads/2025/02/Best-UPI-Cashback-Apps-768x431.webp)