Kiwi UPI App: Lifetime Free Rupay Credit Card & Flat Cashback on UPI Payments

Kiwi was the first UPI application to introduce Rupay-based UPI payments. Along with that, it came up with flat cashback rewards on RuPay-based UPI payments. Today, it is one of the most popular UPI cashback apps.

If you’re looking for a high-rewarding UPI app, you should definitely use the Kiwi app. In this article, we’ll explore what the Kiwi app is.

What is Kiwi App?

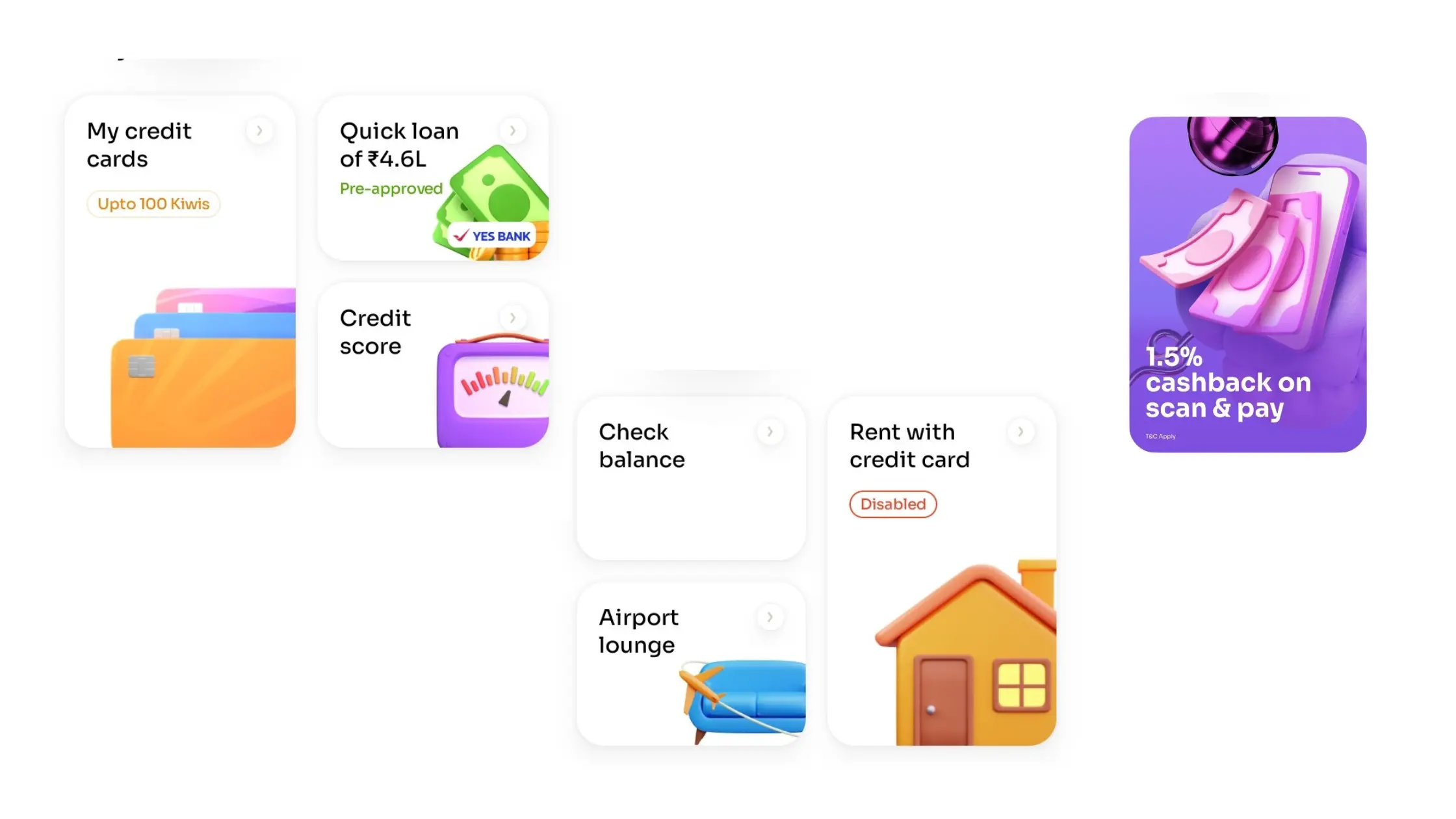

Kiwi is a payment application that offers UPI-based payment facilities, with exclusive benefits on UPI payments for RuPay credit card holders. With the credit card management feature, you can track, manage, and pay your credit card. Additionally, Kiwi offers an exclusive rewards program — Kiwi Neon — providing up to flat 5% cashback on all scan-and-pay UPI payments.

Kiwi App Features

Kiwi is a UPI-based payment app that allows users to make UPI payments over Rupay credit cards and bank accounts. Plus, it offers flat 1.5% cashback on merchant UPI payments made with Kiwi UPI credit card powered by Yes Bank.

✅ Get up to 5% cashback on scan & pay

✅ 5% cashback on spending ₹1.5L in a year

1. Lifetime Free Credit Card

It offers a free Rupay credit card powered by Yes bank — named Click Rupay Card. It is a virtual card that you can use for online and offline payments. Rupay is a product of NPCI, the same company that developed UPI. Therefore, you can make merchant UPI payments, too.

2. Joining Bonus

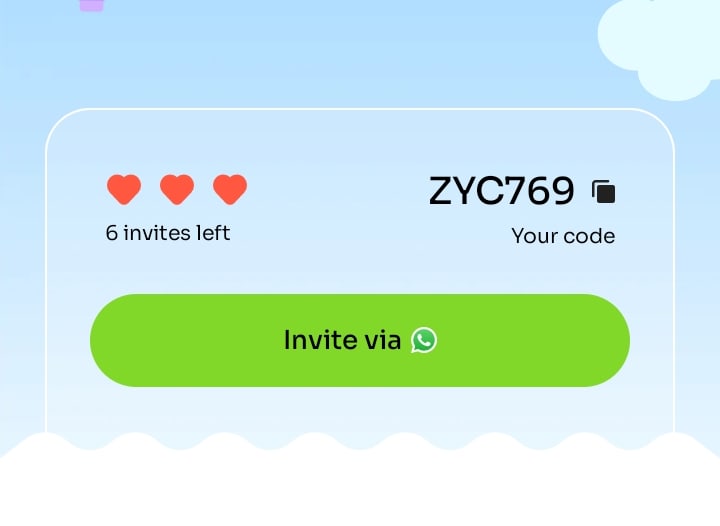

Join Kiwi using referral code, and you will get ₹100 on your first UPI transaction. You will need to complete first UPI payment with the Kiwi Yes Bank’s Rupay credit card to receive cashback. The reward will be added in the form of Kiwis (in-app currency), which you can redeem to receive cash into your bank account.

Download the app below to claim the reward.

3. Cashback on UPI Payments

It offers assured 1.5% cashback on UPI payments over ₹100 via the Rupay credit card, and 2% cashback to Kiwi Neon users. Kiwi Neon is an exclusive, paid subscription from Kiwi that promises additional rewards on UPI payments.

Note: The cashback will only be given when you make payments using the Rupay credit card.

4. Incremental Cashback

Its cashback policy is pretty straightforward: the more you spend, the higher the cashback you get. You’ll get 2% cashback on spending up to ₹50,000. If you spend more than ₹50,000, you’ll start getting a flat 3% cashback on every UPI payment. After the next ₹50,000 spent, it increases to 4%. And once your total spend exceeds ₹1.5 lakh, the cashback increases to 5%.

Milestone rewards on yearly spends on Kiwi App:

- 3% cashback on eligible spends of Rs.50,000

- 4% cashback on eligible spends of Rs.1,00,000

- 5% cashback on eligible spends of Rs.1,50,000

5. Free Longue Access

For each milestone spent, lounge access will be unlocked. For each 50k spent per calendar year, it gives free lounge access, up to 3 per year. The lounge access, when unlocked, will appear on the homepage section. You can claim the pass by scanning the boarding pass.

3. 0.5% Cashback on Online Spends

The RuPay card can be used for online payments, and it offers 0.5% cashback on each non-scan-and-pay transaction.

| Spend Type / Condition | Cashback Rate | Details |

|---|---|---|

| Merchant UPI Payments (₹100+) | 1.5% | Via Kiwi RuPay Credit Card (Yes Bank) |

| Merchant UPI Payments (Kiwi Neon users) | 2% | Must be a Neon member |

| Scan & Pay (UPI Payments) | Up to 5% | On selected merchants, max 5% |

| Spend ₹50,000 (Yearly milestone) | 3% | On eligible UPI spends |

| Spend ₹1,00,000 (Yearly milestone) | 4% | Cashback increases with milestone |

| Spend ₹1,50,000 (Yearly milestone) | 5% | Maximum tier of cashback |

| Joining Bonus | ₹250 | Given as “Kiwis” (redeemable for real cash) |

| Free Airport Lounge Access | Up to 3 per year | 1 lounge access unlocked on every ₹50,000 yearly spend |

Certain transactions are not eligible for cashback rewards or milestone spend calculations. These include payments related to Utilities, Transportation, Government services, Professional and Membership Organisations, Marketing and Advertising, Retail services, Miscellaneous categories, Business services, Agricultural activities, and Horticultural or Veterinary services.

How to Download Kiwi App

1. Visit the Play Store or App Store.

2. Search for “Kiwi UPI App”.

3. Install and open the app.

4. Sign up using your mobile number.

5. Enter referral code to get ₹100 bonus.

6. Apply for your free RuPay credit card within the app.

Kiwi App Referral Code – ZYC769 (Here’s a Little Bonus for You)

If you’re planning to sign up for the Kiwi app, here’s something you shouldn’t miss Kiwi referral code: ZYC769 during sign-up and you’ll get ₹100 credited to your account after your first credit card transaction. Make sure to enter code while signing up to claim referral bonus.

If you’re planning to sign up for the Kiwi app, here’s something you shouldn’t miss Kiwi referral code: ZYC769 during sign-up and you’ll get ₹100 credited to your account after your first credit card transaction. Make sure to enter code while signing up to claim referral bonus.

Pros & Cons of Kiwi UPI App

Kiwi is one of the most rewarding UPI apps, especially if you make a lot of UPI transactions daily. The biggest advantage? You can earn 2-5% cashback on UPI payments over ₹100, which can add up nicely if you use UPI frequently.

Plus, Kiwi’s free credit card can also be used to get exclusive deals from partner brands. Their referral program is another highlight, where you earn decent cashback when friends sign up and get a credit card using your referral.

On the flip side, there are some limitations:

- For example, transactions under ₹100 don’t qualify for cashback, which can be frustrating if you often make small payments.

- Also, the minimum cashback amount you need to get cashback was recently increased from ₹50 to ₹100.

While Kiwi offers good value, it’s not perfect for every user, especially if your transactions tend to be small or infrequent.

Overall, if you’re a heavy UPI user and want to maximise rewards, Kiwi is a great choice. But if you’re looking for cashback on every tiny payment, you might want to explore other apps that don’t have minimum transaction requirements. There are competitors like Jupiter offering their own perks, but that’s a discussion for another time.

| App | Cashback Rate | Free Credit Card | Referral Bonus | Special Feature |

|---|---|---|---|---|

| Kiwi | Up to 5% | ✅ Yes | ₹100 | RuPay UPI via Credit Card |

| Fampay | Up to 1% | ❌ | ₹50 | Teen UPI Card |

| Jupiter | 1% | ✅ | ₹500 | UPI + Credit Line |

| Cred | Variable | Launching soon | up to ₹250 | Rewards for Bill Payment |

What do you think? Have you tried Kiwi? Would you stick with it or try something new?