Credit Card to Bank Transfer App + Additional Cashback

Credit Card to Bank Transfer App

If you’re looking for a way to transfer money from a credit card to a bank account, here’s a method you can use. Usually, when we use credit cards to send money to the bank, we have to pay around 2–3% in charges. But here is an app, using which not only will you effectively save on charges, but also earn cashback. The cashback amount depends on what credit card you use.

What You’ll Need

- You’ll need to install an app called Coupl: Joint Banking.

- It’s available on both Android and iOS

- It is like a digital wallet.

- The name says “Joint Banking.” You can use it individually, just like any other wallet app.

Steps to Transfer Money to Bank using Coupl

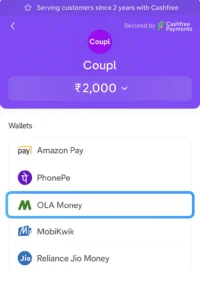

As you know, Coupl allows you to add money using your credit card. The amount you load via credit card can be used to load Ola wallet. And you might know that Ola wallet allows you to send money to a bank account. This is the hack or method we will be using with Coupl.

If your credit card offers cashback on online spending or wallet loading (like SBI Cashback Card, HDFC Swiggy Card, or Axis ACE Card), then you get cashback during the wallet load step. This is the main benefit of using Coupl.

- Download and install the Coupl app

- Complete full KYC inside the app to enable bank transfer

- Add money to Coupl Wallet using your credit card

- In the app, choose Ola Wallet as the load option

- Enter the OTP from your Ola app when asked

- Once the money is loaded into Ola Wallet, go to click Transfer/withdraw section on homepage

- Send the money to your bank account

Charges:

Wallet Load Charges:

- ₹100 = ₹3 fee

- Above ₹100 = 2.18% fee

(e.g., ₹1000 will cost ₹21.80 in fees)

Bank Transfer Charges:

- 0.25% of the transfer amount

If you load ₹40,000 and transfer it to the bank, you’ll have to pay 2.18% (₹872). Now, if we add the transfer to bank changes, which is 0.25% (100). The total charge you will have to pay is ₹972. Now, if your card gives 5% cashback, that’s ₹2000 cashback, so you still gain around ₹1028.

Remember

- Ola Wallet has a limit of ₹10,000 if only mini KYC is done.

- You can use different Ola accounts to bypass this (change number at OTP screen).

This method works best with:

- SBI Cashback Card

- HDFC Swiggy Card

- Axis ACE Card

Not all cards give 5%. Check your card’s terms and rewards before trying. If you don’t receive OTP during the process, contact Coupl support or Ola support. They usually fix it. On your credit card statement, the transaction name may appear differently. That’s normal.

If your credit card supports cashback on wallet loads, then using Coupl + Ola Wallet is a smart way to transfer money to your bank and still earn cashback. It’s not free. There are small charges. But if cashback is more than the charges, you save money.

Disclaimer

This blog is for informational purposes only. The method shared here is based on currently available features and user experiences. App features, card reward policies, or cashback terms may change at any time.

Please verify details with official sources before using. I’m not responsible for any loss, failed cashback, or feature changes that may occur.